Closing Statement Real Estate - Five Automation Steps

In a real estate transaction, a closing statement is a vitally important document. It summarizes all of the agreements that have been made between the buyer and the seller, and it outlines what still needs to be done in order to complete the sale.

A closing statement in real estate is typically prepared by the agent or the escrow company, and it is signed by both the buyer and the seller. Once the real estate closing statement has been signed, it becomes a binding contract between the parties. The closing statement should be reviewed carefully before it is signed, as it can have a significant impact on the final outcome of the transaction.

A real estate settlement is a transactional activity that follows a similar process from closing to closing. To run a profitable residential real estate closing practice, the following steps are almost mandatory. Execution based on a well-defined closing process minimizes re-work and software can automate repetitive tasks and settlement-related transactions. In short, real estate process automation can provide efficiencies in your agency and protect your reputation from mistakes.

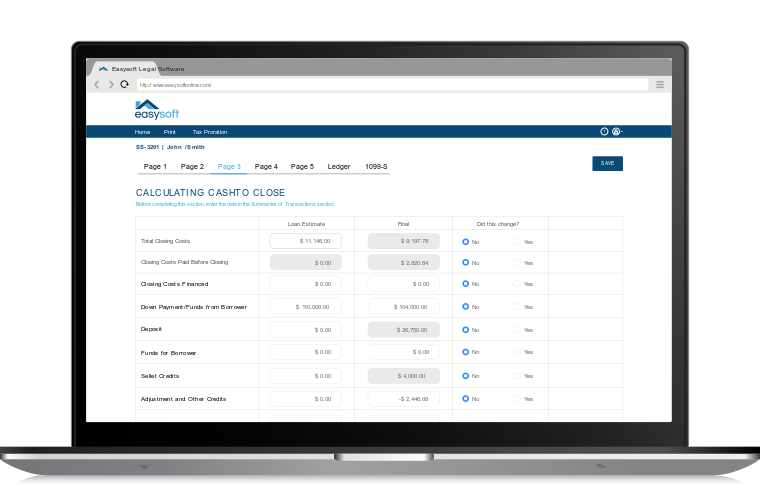

To get the most mileage out of your investment in Easy HUD and trust account management software, Easysoft Legal Software recommends the following:

Populate Forms from a Common Data Set

- Use Easy HUD software with its well-organized "Case Data" section. You can enter file/buyer/seller/property/lender, information and more. Collecting and entering all pertinent data in one place streamlines the entire closing process.

- As part of the closing, you will need to generate a number of letters and documents such as, contracts, deeds, affidavit of titles, power of attorney, etc. Use the "Real Estate Documents" module to generate all needed forms automatically. Easy HUD 4.0 comes with many customizable forms, plus you can add your own forms. Because you enter data only once, you will minimize mistakes and will be able to generate consistent, error-free documents.

- As you enter Case Data, your HUD settlement statement also populates automatically.

- 2010 RESPA rules require a comparison of GFE and HUD charges as part of the settlement process. Preparing HUD settlement statements early using HUD software will enable you to detect and resolve any GFE-HUD discrepancy issues. Always check to make sure you are working with the latest copy of the GFE because lenders are allowed to revise the GFE and often do so.

Lender Worksheet Using HUD Software

- For nearly all charges on the HUD settlement statement, you can utilize the "NET" flag to indicate lender deducted/disbursed items.

- Review "Lender Worksheet" under the "Tools" menu. The "Lender Worksheet" will display the loan’s gross amount and an itemized list of deductions.

- Be sure that you are able to reconcile net funds with the net amount shown on the lender worksheet. You may need to account for extra funds issued, such as a payment to a mortgage broker. Use the "Additional Funds To/From Lender" option button to account for extra funds issued.

Ledger - A Powerful Easy HUD Software Module

- Ledger’s primary purpose is to balance the closing and prepare disbursements.

- Ledger’s secondary purpose is to transfer settlement transactions to the Easy Trust accounting program.

- If changes are made to the HUD settlement statement after the ledger is created, you can recreate the ledger by clicking on the "Re-import Ledger" button.

- You can edit any aspect of transactions displayed without affecting your settlement statement. Some of the most common edits are related to:

- Combining multiple checks issued to the same party.

- Splitting a check between multiple parties.

- Marking a deposit or payment as "wire".

- Removing transactions, which are not being disbursed at the time of closing, for example, when funds remain in escrow.

- Printing ledger checks.

- Printing a closing statement which itemizes all closing transactions.

1099-S Reporting

Once a closing is complete, you can submit 1099-S information to Easysoft Legal Software’s electronic 1099-S filing service (Your firm must first enroll in the service.) By filing the 1099-S as you close, you eliminate year-end tasks, such as re-opening all files and manually typing 1099-S forms for sellers and the IRS. Our filing service will take care of it all. There is no need to type anything because virtually all 1099-S required data was already entered in the HUD. File as you close and get a confirmation number immediately. Save time with real estate process automation.

Trust Accounting

Finally, here is the most important function that law firms often neglect -entering closing ledger data in trust accounts. With Easy HUD software, once a HUD closing is complete, you can transfer the HUD closing ledger to Easy Trust, a complete trust account management system that keeps track of all aspects of client funds, bank reconciliations and generation of required reports.

Why automate real estate closing statements

A real estate closing statement can be a daunting document for buyers and sellers alike, but it is an important part of the transaction. Automating the closing statement can help to streamline the process and ensure that all of the necessary information is included. In addition, with real estate process automation, you’ll make closing statements more efficient. As a result, real estate professionals who use process automation can save time and money while providing a better experience for their clients.

Additionally, automating the closing statement can help to reduce the likelihood of errors, which can save time and money for both buyers and sellers. Avoid this time-consuming and error-prone process with real estate process automation. By automating the preparation of closing statements, realtors can free up their time to focus on other tasks, and they can avoid costly mistakes.

Ultimately, real estate process automation can help to make the real estate transaction smoother and simpler for all involved.

Easy HUD 4.0 makes the residential closing procedure simple. The software minimizes data re-entry and ensures accuracy of closing details and financial calculations. Easysoft Legal Software has been developing and selling real estate closing software for more than two decades. Thousands of customers use real estate process automation through Easy HUD to streamline closings, eliminate costly mistakes and boost profitability.

Follow these steps to prepare real estate documents, settlement statements, disbursements, trust account management and 1099-S reporting, and your firm can reap significant savings in the real estate closing process.

Find out more about why thousands of settlement agents, law firms and title companies choose Easy HUD, HUD Software for real estate closings.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.