2010 RESPA Rules

For the first time in more than 30 years, the U.S. Department of Housing and Urban Development (HUD) has issued the final RESPA rules (341 page document). HUD enacted these RESPA reforms for the purpose of enacting a more comprehensive and explanatory mortgage financing application to reduce costs in the settlement process. The purpose of these dramatic changes is to reduce costs and foster understanding of the mortgage financing process. The final rule mandates an accurate GFE early in the application process to enable the borrower to shop effectively, (to address the problems that consumers have been facing as of late).

These changes are substantial and require the settlement agent to be conversant with the new forms and applications.

Mandatory date of the final RESPA rule was January 1, 2010. Apart from many other changes outlined in these rules, there are extensive changes made in Good Faith Estimates (GFE), HUD-1 and HUD-1A settlement statements.

The final RESPA rules include:

- New GFE form. Closing costs have been consolidated into categories to prevent "unnecessary itemization" (or as some call it “junk fees”) and displays total estimated settlement charges prominently on the first page.

- New HUD-1 and HUD-1A settlement statements. The HUD-1/HUD-1A now have references on most lines to the corresponding GFE sections. Borrowers can now easily compare GFE’s estimated cost with HUD-1/HUD-1A final costs. The new forms also have an additional page that includes a chart comparing the amounts listed for particular settlement items on the GFE with the costs listed for those items on the HUD-1/HUD-1A.

Key elements of the final RESPA rules:

- Mortgage lenders and brokers are now required to provide borrowers with a standard GFE that answers key questions for borrowers, including the loan’s terms; whether the interest rate is fixed or otherwise; any prepayment penalties and/or balloon payments; and total closing costs.

- The GFE and the HUD-1/HUD-1A forms have been redesigned so that borrowers can compare estimated and actual settlement costs.

- Lender payments to mortgage brokers, known as yield-spread premiums, to be disclosed in a standard way on both GFE and HUD-1/HUD-1A.

- Disclosure of the agent/underwriter premium split of title insurance charges on the HUD-1/HUD-1A.

- Deviation from GFE and actual charges from HUD-1/HUD-1A: A tolerance range has been specified for various categories to prevent unnecessary escalation of promised vs. actual charges. Borrowers will have 30 days after the closings to recover overcharges.

- Loan origination charges and property transfer taxes can not change from proposed vs. actual. (0% tolerance.)

- Total of Lender provided services or service providers identified by lender (e.g. title insurance) as well as government recording charges can not change more than 10%. Individual services may exceed the tolerance as long as the total does not exceed 10%.

New HUD Forms:

The following is a summary of changes in the new HUD-1 form. New HUD-1A form changes are substantially similar and are not discussed here.

- Page 1: page format is essentially similar and there are no significant changes.

- Page 2: All sections now have a reference to corresponding GFE sections

- Section 700 (Total real estate broker fees): No changes.

- Section 800 (Items payable in connection with loan): Substantial changes. Most substantial and controversial change is disclosure of yield-spread premium as a credit (entered as negative amount) to borrower in line 802.

- Section 900 (Items required by lender to be paid in advance: Minor changes including rearrangement of line titles.

- Section 1000 (Reserves deposited with lender): Substantial changes. Total initial deposit is now entered in line 1001. Itemization of this amount follows from 1002-1006. 1007 is retained for Aggregate Adjustments (entered as negative amount).

- Section 1100 (Title charges): Completely reworked. Itemization of title charges are removed and total charge is entered in 1101 for easier comparison. Most controversial new addition now requires disclosure of title insurance premium split between agent and underwriter on line 1107 and 1108.

- Section 1200 (Govt recording and transfer charges): Substantial changes. Sum of recording charges is now in line 1201 and itemization is in 1202. Similarly, sum of transfer taxes is now in line 1203 and itemization is in 1204-1205.

- Section 1300 (Additional settlement charges): Substantial changes. Summary of charges from service providers which borrower may select is in line 1301 and itemization is in line 1302-1303.

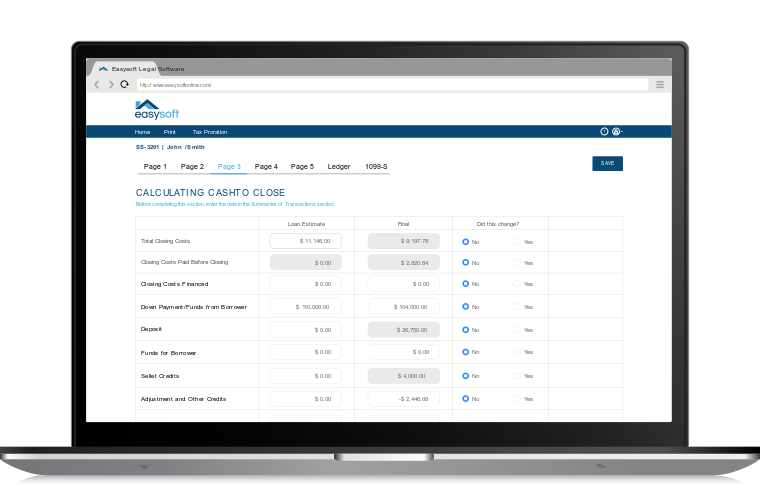

- Page 3: Newly added page. Comparison of Good Faith Estimate (GFE) and HUD-1/HUD-1A Charges.

- Charges Comparison section: The comparison chart must be prepared using the exact information and amounts from the GFE and the actual settlement charges shown on the HUD-1/HUD-1A Settlement Statement. The comparison chart is comprised of three sections: "Charges That Cannot Increase," "Charges That Cannot Increase More Than 10%," and "Charges That Can Change."

- Loan Terms section: This section must be completed in accordance with the information and instructions provided by the lender. The lender provides this information in a format that permits the settlement agent to enter the necessary information in the appropriate spaces, without the settlement agent having to refer to the loan documents.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.