The Truth Behind Electronic 1099-S Forms And

Real Estate Title Software

Most of us dread filing our tax forms. Real estate professionals, in addition to dealing with the usual business forms, also have to file 1099-S forms each time they close a sale. Many firms put off the filing, doing the entire year's forms at the end of the year rather than when they file the HUD-1 settlement statement. Today's agents have the option of filing 1099-S forms electronically, but is that the best choice? There is a lot of information out there about the process, not all of it accurate, and we wanted to get to the reality of the matter.

Electronic Filing Benefits

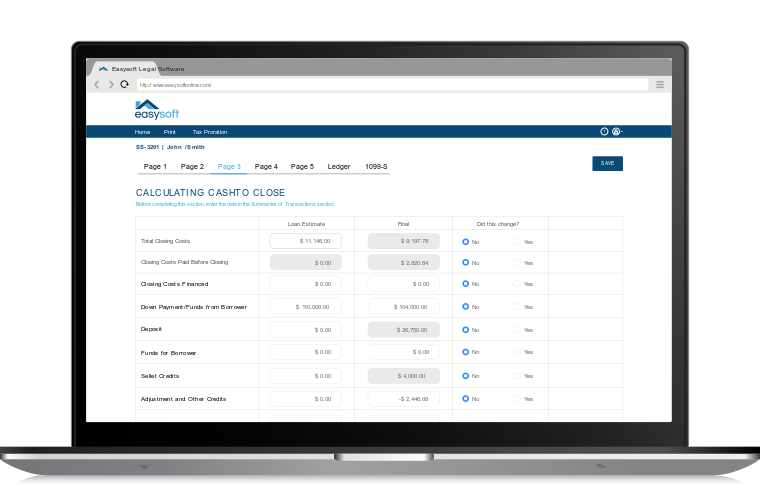

One of the biggest benefits of electronic filing is that it's so simple that there is no reason to put it off to the end of the year. HUD settlement statement software with electronic 1099-S filing makes it literally a click away. It becomes an automatic part of real estate closing so you can close the file immediately and move on with your business. There is no danger of overlooking, and you don't have to dread the stack of filings at the end of the year.

Electronic filing is more accurate than paper filing. The software pulls needed information right from the HUD form so you know the information on the 1099-S is correct. You don't have to worry about transposing digits or accidentally pulling the wrong number off the form. Fewer errors mean fewer IRS returns and faster closing.

Electronic Filing Myths

As we said above, not all of the information you can find about electronic filing is accurate. Here are the most common myths about electronic 1099s.

- It's Not A Real Document - There have been countless court cases about the validity of electronic documents. Multiple legal precedents have made it clear: electronic documents are just as valid as paper ones.

- The IRS Doesn't Accept Them - The tax agency has embraced digital information over the last few years. The IRS not only accepts electronic filing but prefers it. The IRS has specific format requirements for submission, but the title closing software will take care of that for you.

- It's Insecure - With all the stories of hacking and identity theft, it's a bit frightening to transmit tax information over the internet. However if you deal with a reputable provider, the 1099-S is not transmitted in a way anyone else can read it. The transmission is encrypted so if it is intercepted, it will be gibberish to anyone but the recipient.

- It's Expensive - There is usually a small fee associated with electronic filing, just as there is for filing your 1040. Arguably this fee is higher than the cost of a stamp, but you are saving more than postage. You are saving your time, which is valuable, and you are minimizing the chance of incorrect or misfiled forms, saving even more time.

As with any software or electronic service, you need to deal with a reputable vendor. Look for an experienced provider of real estate and legal practice management software to find secure, easy and affordable electronic 1099-S filing.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.