Software Designed for Managing Real Estate

Updated: December 2021

Real estate closing is the process of finishing a transaction and transferring ownership of the property from the seller to the buyer. It can be complex and time-consuming, involving everything from title searches and loan processing to inspections and repairs.

In recent years, however, real estate closing technology has played an increasingly important role in streamlining the real estate closing process and making it more efficient. This means you save more time on closing processes and, as a result, your efficiency and profitability will rise.

How to Leverage Technology and Increase Accuracy, Productivity & Profits

Similar to other areas of law, such as bankruptcy and family law, document production drives real estate transactions. There are numerous important routine tasks associated with every residential real estate closing.

The Federal Real Estate Settlement Procedures Act (RESPA) requires that the parties at closing receive written settlement statements, including Forms HUD-1 (purchase) or HUD-1A (refinance). More recent RESPA Rules have significantly complicated the HUD settlement statement and its relationship with the Good Faith Estimates (GFE).

Coordinating the Real Estate Closing Process

The Predictable Repetitive Tasks

Handling the varied aspects of a typical real estate closing transaction requires coordination, not only of the involved parties (i.e., who's doing what among the buyer, seller, lender, title company, and attorneys) but also managing a host of critical, time-sensitive tasks. The real estate closing process requires close follow-up and follow-through, when carrying out tasks, such as:

- Initial contract drafting and negotiations.

- Scheduling and conducting various property records searches, including coordinating results and amending contracts as necessary.

- Scheduling the closing date.

- Preparing HUD settlement statements (typically, Form HUD-1 or HUD-1A).

- Coordinating procurement of title insurance.

- Paying off the seller's mortgage.

- Conducting the loan closing, including receiving and handling funds from the buyer and their lender(s), and disbursements to the seller, the seller's mortgagor and all appropriate parties (attorneys for buyer and seller, realtors, mortgage broker, etc. )

- Maintaining accurate and current records for client trust account transactions in compliance with state and federal law.

- Filing appropriate IRS Form 1099-S for proceeds from the real estate transactions.

Other post-closing activities, including the filing of record of deeds, mortgages, liens, affidavits and the like.

Final Closing Tasks

For the settlement agent, the job doesn't end once the legal documents are signed, sealed and delivered. Other responsibilities include:

- Closing disbursements.

- Accounting for trust transactions.

- Reporting sales proceeds to the Internal Revenue Service.

Closing Disbursements & Client Trust Accounting

When writing checks for a property settlement, attorneys must adhere to stringent state laws regarding client trust accounting, most notably IOLTA or IOLA, and professional ethics rules.

Income Tax Reporting for Real Estate Sales

Reporting proceeds for income tax purposes adds to the workload. Multi-part IRS forms, such as the 1099-S must be completed accurately and filed, and a copy must be sent to the seller in connection with every eligible transaction.

Clearly, today's real estate closing professionals have many challenges and responsibilities. As with many other areas of law, real estate law requires expertise in contracts, accounting, negotiations, taxes, title matters, banking, and federal Truth in Lending laws.

The transactional portion of real estate law means that lawyers must keep exacting records, under penalty of fine and/or imprisonment or disbarment.

To avoid headaches (or worse), today’s lawyers can streamline real estate closing processes with technology.

Technology to the Rescue

As successful lawyers have quickly recognized, technology is a great boon to the real estate closing process. In fact, most real estate lawyers today use computers in combination with one or more software programs, along with the Internet to accomplish a myriad of real estate closing tasks.

Macros and templates are often used to automate certain processes, using two or more separate software programs. However, manipulating multiple real estate closing software products to handle a single real estate transaction, not only wastes valuable time, but greatly increases the risk of error, a drawback that defeats the purpose of automating the real estate closing transaction in the first place.

21st Century Software

While software products that automate real estate closing documents have been around since at least the early 1990s, today's best software designed for real estate lawyers automatically generates closing documents, as well as the calculations for each step of the closing process, from start to finish. Real estate closing technology has come leaps and bounds since the 1990s and the features and integrations now available make the use of software even more logical for real estate law firms.

How Automation Works

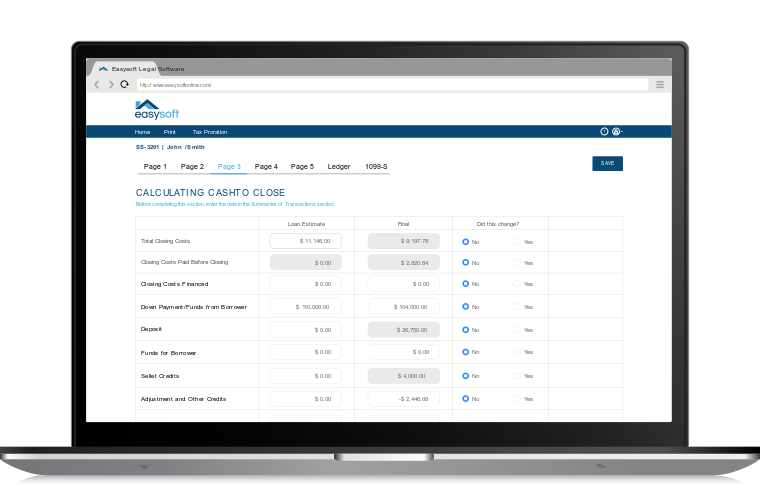

Software that is used for generating real estate documents full of calculations and specific file information contains a database. When detailed information is entered about your real estate closing such as, the buyer's and seller's names and addresses, property description, purchase amount, etc. only once, any edits and updates are universally carried across all the documents.

You no longer lose time searching for and correcting typographical errors and name spellings on each and every document; and accurate, consistent output is ensured. With the proper real estate closing software, you can automate the entire closing process, not just bits and pieces.

Tips for Finding the Right Software Solution

Avoid common real estate preparation pitfalls. Look for software that draws upon a dynamic information database that is always current and readily available to all team members.

The optimum software solution should completely automate real estate closings by:

- Generating closing documents

- Tracking tasks

- Accounting for and reporting monies

- Handling IRS reporting

- Managing most routine aspects of any type of transaction

Real Estate Software Selection - Three Crucial Elements

There are many considerations, when choosing real estate closing technology, however, significant improvement in productivity and efficiency, accuracy and profits stems from integrating the following three elements:

- HUD settlement statement preparation

- Document assembly

- Accounting (automatic calculation of loan funding, all state charges and fees, and disbursement of and accounting for monies)

Once you have narrowed the field to software programs that handle these three key elements, consider how effectively (or ineffectively) each will assist in implementing HUD settlement preparation, integrated document assembly, and accounting features.

How to Evaluate the Key Software Elements

The details below will help you narrow real estate software choices even further. Use the needs of your real estate practice as a guide to further assess the real estate closing technology you are considering.

HUD Settlement Statement Drive the Closing Process

For any residential real estate closing, HUD settlement statements are at the root of the process. HUD settlement statements record details of each and every financial transaction among all parties involved in the deal.

Additionally, multiple parties review HUD settlement statements to account for their proceeds and responsibilities.

By keeping the HUD settlement statement as the focal point in the closing process, you can automate the following tasks:

- Accurately compute and record tax proration, recording charges, and transfer taxes.

- Keep track of lender's fee deductions as well as lender made disbursements, which allows you to compute net funding, driven from the HUD data.

- Determine the exact funds needed from buyer and proceeds to the seller, realtors and all other settlement service providers.

- Accurately prepare disbursements and keep track of net funding from lenders and any POC payments, etc. If for any reason the HUD is not balanced, it will be readily apparent.

- Print checks directly from the software's disbursement ledger.

All the above items are critical and interrelated tasks that a good real estate closing program package should accomplish for you.

Document Assembly

A large part of a real estate lawyer's function is the preparation of various documents, such as contracts, deeds, mortgages, leases, the closing, and HUD settlement statements.

Because these documents contain a considerable amount of standard language, and share many variables with other related documents (i.e., buyers' and sellers' names and addresses, property addresses, etc.), the most productive and cost-effective method of document assembly is to generate the data automatically. This can be achieved through competent real estate closing technology.

Data generation is often achieved by merging common document templates with a database of live information. Since documents are generated from a common dataset, changes are made quickly and uniformly implemented by simply re-generating the appropriate documents.

While a similar effect has been accomplished for years by creating and using custom forms, templates, macros, or document mergers with word-processing programs such as Microsoft Word, those stalwart methods fall short today, for a couple of reasons.

First, there's the investment of time and money required to create them, and second and perhaps more importantly, the data remains captive to that program, and must be re-entered in another software program to perform other related tasks.

Of course, proofreading becomes a nightmare, since the lack of uniformity means each document has to be scrutinized for accuracy.

Another practical advantage to closing technology is the ability to keep your HUD settlement statements and all other closing documents current and compliant with preparation integrated maintenance. A few months after the closing, if you need to locate a closing document in the integrated software program, you simply locate the master client files and preview all documents prepared at the time of the closing. Thus, you eliminate the need to search a multitude of documents in different folders, directories and software programs to find the document you need. Another way that real estate closing technology saves you even more time.

Accounting

The ideal real estate software for law firms generates closing and settlement statements that comply with client trust accounting laws and rules and is one that is automatic, accurate, and worry-free.

A lawyer acting as the settlement agent receives and disburses closing funds. However, since all closing funds flow through a lawyer's trust account, real estate closing software must directly interface with trust account management software. Any manual re-entry of closing transactions places you at risk of error.

While a case can be made for keeping trust account books as part of the same real estate closing system, it is often not practical, since an attorney's other practice areas may also involve trust transactions.

The final step to complete a real estate closing transaction is filing a 1099-S form to report proceeds from the sale or exchange of real estate. In general, a settlement agent is required to file a 1099-S form with the IRS and provide an official copy to the seller.

It is a common practice to file the prior year's 1099-S forms at the beginning of a new year, which requires re-opening all closed files to extract pertinent settlement information.

A better method is to enroll in a third-party filing service that allows you to transmit information to the filing service as you close. If your real estate closing software can directly interface with such filing service, it is icing on the cake.

Avoid Software with Unnecessary Features

It is important to be on the lookout for programs loaded with features/integration you do not need as a real estate attorney.

For example, if your firm does not produce title binders (produced by title agents), the feature may cost you more to purchase and maintain, and data input will be unnecessarily complex due to input of unnecessary and unused information.

The flat fee nature of the real estate closing practice demands a sharp focus on efficiency.

Technology gives your firm a competitive edge for preparing HUD settlement statements and other closing documents. One way for law firms, large and small, to remain competitive in today's economic climate is to take advantage of the latest technology to boost profits, increase efficiency and productivity.

With the perfect software solution, you can automate the entire closing process, maximize productivity by building upon a central database of information, generate final-form documents, eliminate redundant data entry and handle all aspects of real estate accounting.

Real Estate Closing Technology can Streamline Your Process

Real estate closings are a fundamental part of any transaction, and it is important to have a process in place that is efficient and accurate. One way to achieve this is by leveraging technology. Easysoft Legal Software can help with tasks such as creating and managing documents, staying accurate and accountable, and communicating with clients.

By using these tools, you can increase your productivity and profits. In addition, you can also use real estate closing technology to improve the accuracy of your process. With real estate closing technology, you can make your real estate closing process more efficient and profitable.

Easysoft Legal Software has been a leading real estate closing legal software provider since 1986. We offer specialized solutions for real estate firms across the United States. Thousands of customers use our legal software products to increase their office productivity. Learn more when you book a demo and begin a FREE trial.

Easysoft - the power you need at a price you can afford.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.