Preparing HUD Settlement Statements How

HUD Templates Boost Profitability

HUD Settlement Statement Required

Most residential real estate transactions whether they are a purchase, sale or refinancing, call for preparation of a HUD Settlement Statement. The Real Estate Settlement Procedures Act (RESPA) mandates a document generally referred to as the HUD Settlement Statement, which requires multiple parties’ approval (e.g. the lender and the other party’s attorney) before a closing can take place. For the purpose of easier disclosure and compliance, information must be entered in a specific HUD Settlement Statement format and style.

Simplify the Documentation Process

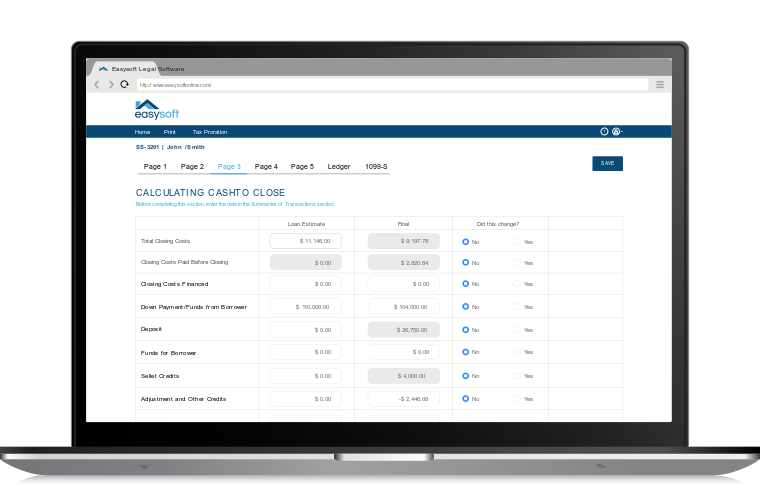

Real estate closing transactions involve multiple calculations and a stack of documents. Typically, HUD preparation alone takes several hours due to all the revisions the settlement statement goes through. The key to lessening the complexity of correctly preparing and assembling required documents is automation.

Reduce Real Estate Closing Preparation Time

To efficiently prepare and assemble real estate closing documents, you need to automate. Instead of entering real estate closing data over and over, what if you entered it just once? What if calculations were automatically performed and always accurate? What if closings were always balanced?

Create Templates for Efficiency

Most lenders and title agencies have fixed amount charges and require the HUD in a certain format. Because real estate firms routinely work with same lenders and title agencies, here is how you can streamline your HUD preparation:

- Create templates for each lender and title agency that you commonly use.

- Even better, you can make a template with lender A and title agency B combination.

- Pre-enter all common charges and text labels. Leave amounts blank or annotate with a large number such as 99999999.99, as a reminder that the value needs to be filled in.

- When you get a new client, check to see if a template exists for the lender/title company combination you need. If you expect to work with the combination again, consider making a template.

Increase Productivity and Profitability

By using real estate closing software applications and creating templates, law firms, and title and escrow companies can:

- Standardize (an entire workgroup can use the same starting templates for a closing).

- Minimize errors (as templates have already been used or reviewed earlier).

- Save time (no need to figure out required format again and again).

Streamline workflow, develop templates and automate repetitive tasks. You’ll increase productivity and improve profit margins.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.