1099-S Reporting - Make it Easy on Yourself

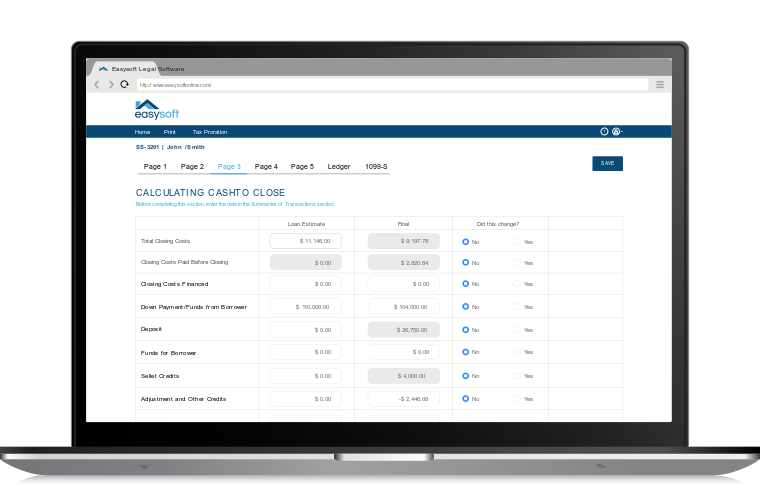

EasyCDF – Fully TRID Compliant Real Estate Closing Software.

While taxes are inevitable and the filing process is generally a dreaded end-of-the-year task, when it comes to 1099-S form preparation and reporting, the job is faster and more easily completed than you may think.

What is a 1099-S?

Among countless IRS forms is the 1099-S, which is used to report the proceeds from the sale or exchange of real estate. The settlement agent, whether an individual or firm, is responsible for filing accurate 1099-S forms for the seller(s). A 1099-S form contains pertinent information, such as the name of the seller, Social Security or tax identification number (TIN), the gross proceeds and other particulars about the real estate transaction.

Manual 1099-S Preparation

Typically, 1099-S forms and the 1096 Summary sheet are prepared at the beginning of the year. Someone in your office will have to go through all your transaction records for the previous year, re-capture and re-type required information on 1099-S forms or send the information to a CPA or third party providers where the information must be entered again. The more often information is re-typed, the more likely it is that errors will occur.

Automatic, Accurate, Paperless 1099-S Reporting

What if you could eliminate the risk of errors and avoid end of the year discovery of missing information? You can! Automate the process by establishing and activating a free account with a 1099 filing service. As soon as a real estate transaction closes, with a click of a button you can:

- Automatically assemble paperless 1099-S forms, even for multiple seller filings

- Validate the required 1099-S fields for completeness and accuracy

- Receive an immediate confirmation number, once 1099 data is submitted and accepted by the filing service

- Have a 1099 copy mailed to the seller on IRS stationary

- Pay only $10 per filing

And - all your IRS reporting requirements are complete.

Use a 1099-S electronic filing service to come to your rescue. Not only will you avoid end of the year 1099-S preparation and filing hassles, but your real estate practice will also save time and money.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.