Short Sale Process

In the current housing market, many homeowners are struggling with increases in Adjustable Rate Mortgages (ARMs), inflation, job losses, etc. and find themselves in danger of foreclosure or bankruptcy.

There is an option for the borrower (if they have a single or primary loan) and the lender. To avoid losing more money on a home loan that would go to foreclosure auction, they can employ a technique called a short sale. During a short sale, the lender accepts a discount on a mortgage.

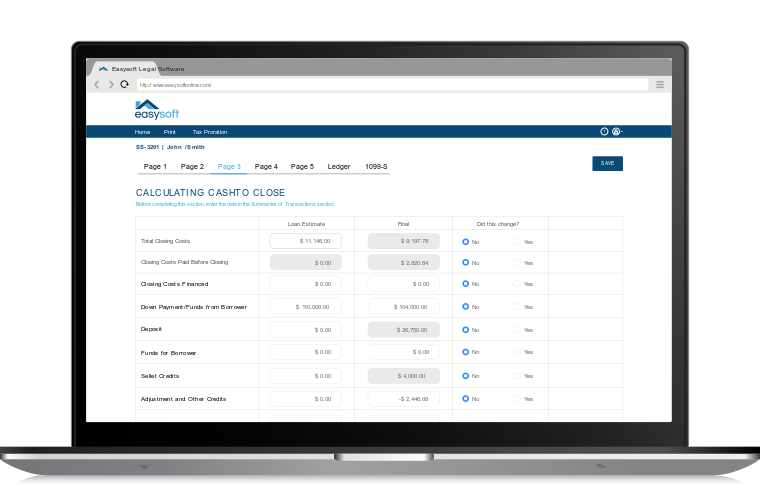

With a short sale, attorneys like yourself will still need a HUD statement for closing. Luckily, there is software that automates your closing settlement statements.

Prepare a Preliminary HUD Settlement Statement Early

A HUD Settlement Statement for closing a short sale shows all expenses and disbursement of funds involved in the residential real estate transaction. It is part of the standard closing paperwork. A preliminary HUD-1 statement is also part of the short sale package. Real estate professionals handling a short sale transaction need to prepare a HUD Settlement Statement early and accurately to avoid unexpected borrower expenses at closing. This settlement statement in real estate can also be used as a negotiating tool.

An Important Negotiating Tool

Since most title companies will not do numerous preliminary HUD-1 statements on short sales, it is imperative that the realtors or attorneys involved learn how to complete the HUD-1 form and present it to the lender. A preliminary HUD-1 is the most important tool in the process of negotiating with the lender to accept less than full payment on an outstanding loan.

As part of the short sale negotiation, the attorney or realtor gives the lender a preliminary HUD statement showing an amount the lender can expect to receive from the sale (short sale net proceeds).

Accurate Calculation of Loan Expenses & Proceeds

To prepare a HUD-1, the attorney/realtor must assemble outstanding and future expenses that could affect the closing, including transfer taxes, broker commission, attorney fees, release fees and any other items that will be paid out of the proceeds of the sale. In a short sale, the lender receives the net balance, after all closing fees are paid. When you calculate closing costs accurately, the lender can expect to receive net proceeds shown on the preliminary HUD-1 Statement.

Once the lender has agreed to accept the amount as shown on the preliminary HUD-1, if the final expenses on the HUD-1 are greater than the agreed amount, the seller must pay the difference or the short sale approval will have to be renegotiated. A correct listing and calculation of all possible seller expenses on the preliminary HUD-1 can help you avoid unexpected seller costs at closing.

Where can I find my HUD-1 settlement statement?

As an attorney, you can find your closing settlement statement (HUD-1) from your closing agent, title company, or lender. This document is typically prepared by the closing agent and lists all of the charges and credits associated with the closing of a real estate transaction. The HUD-1 is required by the Department of Housing and Urban Development (HUD) and must be provided to all parties in a real estate transaction prior to closing.

Easysoft’s HUD Software to the Rescue

Real estate professionals and attorneys nationwide use hud software to prepare HUD Settlement Statements for all residential real estate transactions, including preliminary HUD statements used to negotiate short sales.

Attorneys need to be judicious when it comes to purchasing software. Although there are many programs available that offer a wide variety of features, not all of them are necessary for the short sale process, real estate settlement statements, and general closings.

Attorneys should only purchase software that has the specific features they need and is within their budget. Trying to save money by using free or lower-priced alternatives is usually not worth the risk. These programs often lack important features or are difficult to use, which can end up costing more in the long run. Purchasing the wrong software can also lead to delays and errors in your closing settlement statements. Therefore, it is essential that attorneys take the time to research their options and select the best software for their needs.

Easy HUD has all the features you need to ensure that your short sale transaction preliminary HUD-1 statement is one the lender can easily understand and that will help them make a timely decision on whether or not to accept the short sale proposition you present on behalf of the borrower. Book a demo today and see how easy it is to prepare a HUD statement for closing.