The Role Of Lifestyle Analysis In Divorce Settlements

Like so many aspects of divorce settlements, alimony calculation ultimately boils down to crunching the numbers. The problem is finding the right numbers to crunch. Lifestyle analysis helps determine how much money a spouse needs to maintain a certain standard of living but it can be tedious so many attorneys hire outside accountants to do the work. Divorce Financials divorce settlement software has a built-in lifestyle analysis tool that allows family law attorneys to do the work themselves.

The Basics Of Lifestyle Analysis

Most people can’t tell you how much money they need to survive. Few of us really pay attention to our monthly expenditures, even if we have a budget. When faced with the question, clients will grossly under- or over-estimate their financial needs. Rather than expecting clients to pull numbers out of the air, family law attorneys analyze financial statements, tax returns and other documents to see how much the couple actually spent during their marriage.

The basic idea is that this analysis will give an objective measure of the lifestyle the spouse was used to, and therefore help determine how much alimony is fair to maintain the same or a similar standard of living. However lifestyle analysis can do more.

Uncovering Secrets

Unfortunately some spouses who see a divorce coming will deliberately spend assets in order to keep them from the other spouse. This wasteful dissipation is looked on unfavorably by courts, but it is necessary to provide documentation that this was wasteful and not normal spending. Lifestyle analysis can show how spending by one spouse greatly increased in the weeks or months leading up to the divorce.

Careful study of financial records can also uncover hidden assets. Spouses will sometimes siphon off martial assets into personal accounts. This could be in response to the pending divorce or it could have been going on for years. Once all the money is tracked, the spouse may have to explain to a judge why $10,000 of monthly income translated to only $7,000 of spending, with the remainder having mysteriously disappeared.

Finally, lifestyle analysis can reveal other problems such as infidelity, gambling or illegal drug use. Although most modern divorces are no-fault, such evidence can be important in custody determination.

Lifestyle Analysis Made Easy

Lawyers aren’t accountants, but with today’s family attorney software they don’t have to be. Integrated analysis tools in Divorce Financials give the average attorney access to the expertise that used to require hiring outside consultants. Attorneys can analyze financial information quickly and accurately, and at a fraction of the cost of hiring a professional accountant.

Should you choose to use an outside accountant, Divorce Financials is still useful. All of the information is gathered in one place so the accountant can do the analysis quickly, bill fewer hours, and the attorney still saves money.

Divorce Financials divorce software for attorneys includes other powerful financial tools such as pension valuation, alimony buyout calculation, and tax optimization. Give yourself the edge in divorce negotiations by equipping yourself with court-ready reports that objectively prove your client’s needs.

Quick Links

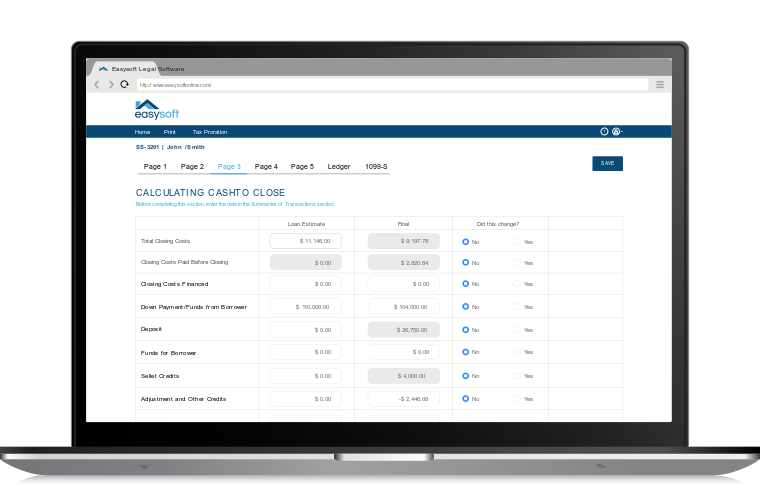

Learn more about EasyCDF 2015 TILA-RESPA (TRID). Compliant 5-page Closing Disclosure Software. Reduce closing time up to 80% and remain compliant with Easy CDF.

Start Your Free 7-Day Trial

No downloads or software to install.

Complete this form for a quick demonstration with a product consultant to begin your free 7-day trial.

Can't see the form below? Click here or please disable your privacy blocker.